The Halloween effect caught up with the stock market! October 31 ended up being a spooky day for investors.

The Halloween effect caught up with the stock market! October 31 ended up being a spooky day for investors.

Tepid earnings from big tech companies and negative news about Super Micro Computer (SMCI) sent stocks plunging, especially semiconductors (more on this below).

Precious metals, which were in a roaring bull rally, also sold off. Gold futures were down 1.84% and silver prices fell 3.76%. Risk aversion seems to be back, with the Cboe Volatility Index ($VIX) rising by 13.81%, closing at 23.16. As uncertainty about the upcoming US election results creeps up, the VIX could rise further. If there’s one indicator to monitor in the next few trading days, the VIX would make the top of the list.

Economic Data Supports a Rate Cut

There was a smorgasbord of economic data this week, most supporting the idea that the Federal Reserve will likely cut interest rates by 25 basis points. Some key data that was released are:

- Wednesday’s JOLTS report shows that in September, US job openings were lower than expected.

- The GDP for Q3 grew 2.8%, below the 3.1% estimate. Consumer spending was one of the biggest contributors to the GDP growth.

- October consumer confidence rose over 11%, the biggest one-month rise since March 2021.

- September Personal Consumption Expenditures Price Index (PCE) shows a 12-month inflation rate of 2.1%.

Friday’s Nonfarm Payrolls should give more clarity to the Fed’s interest rate decision.

Tech Sector Gets Slammed

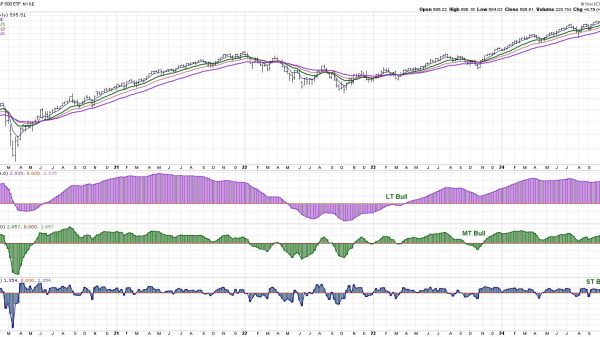

The StockCharts MarketCarpets for S&P 500 stocks by performance was a sea of red (see below). The Technology sector was the worst-performing sector of the day with the Technology Select Sector SPDR Fund (XLK) down 3.21% on Thursday. The largest weighted tech companies in the S&P 500—Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Broadcom (AVGO), and Oracle (ORCL)—took a scary downward ride.

FIGURE 1. STOCKCHARTS MARKETCARPETS FOR OCTOBER 31. The Technology sector got slammed, as did most other sectors. Energy and Utilities were mostly green. Image source: StockChartsACP. For educational purposes.

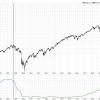

A big blow to semiconductors was SMCI’s news of its auditor’s resignation. The VanEck Vectors Semiconductor ETF (SMH) fell 3.65%. SMH has fallen below its 50-day simple moving average (SMA) with a declining StockCharts Technical Rank (SCTR), moving average convergence/divergence (MACD), and performance relative to the S&P 500 (see chart below).

FIGURE 2. DAILY CHART OF THE VANECK VECTORS SEMICONDUCTOR ETF (SMH). Thursday’s selloff sent SMH below its 50-day moving average. Other indicators show an increase in selling pressure.Chart source: StockChartsACP. For educational purposes.

Thursday’s price action reminds us that things can change quickly, especially when the market has shown indecision for a while. Any negative news will cause a massive selloff, and if it impacts a sector that heavily influences the market, the selloff can be brutal.

There’s More To Come

On a positive note, from a long-term perspective, the broader indexes are still in an uptrend. Apple (AAPL), Amazon (AMZN), and Intel (INTC) reported earnings on Thursday after the close. While all of them beat estimates, Apple’s net income was lower. This could hurt its stock price, but probably not enough to bring the entire market down.

The more important news to pay attention to is Friday’s jobs number. The October nonfarm payrolls will be released at 8:30 a.m. on Friday. As of this writing, the Fed’s probability of cutting interest rates by 25 basis points is 94.6%. Let’s see how much that changes after the jobs data comes out.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.