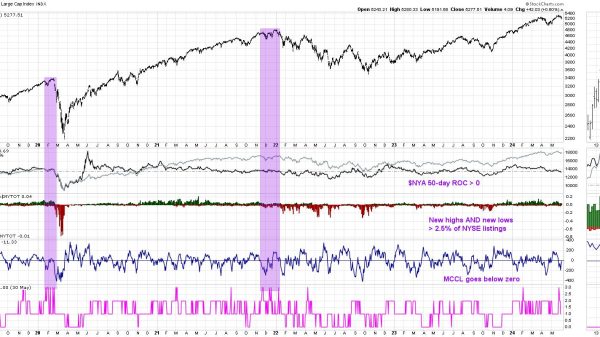

Amazon shares climbed more than 3% in intraday trading on Wednesday, pushing the company’s market cap past $2 trillion for the first time.

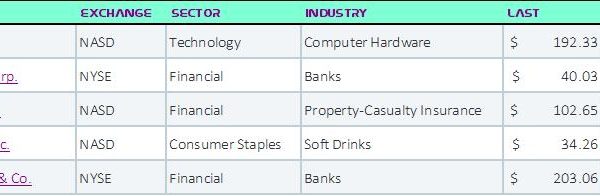

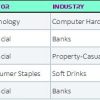

In crossing the milestone, Amazon join Nvidia, Apple, Alphabet and Microsoft, all of which are worth $2 trillion or more. Investors have piled into tech stocks recently as excitement around generative artificial intelligence has reached a fever pitch. Nvidia, which makes graphics processors for the servers that power large AI models, has been one of the biggest beneficiaries, with its market value soaring from $2 trillion to $3 trillion in just over 3 months.

Shares of Amazon have surged roughly 26% so far this year, while the tech-heavy Nasdaq has risen about 18% over the same period.

In April, the company reported first-quarter earnings that showed its Amazon Web Services business was continuing to rebound from a recent slowdown caused by businesses who trimmed their cloud spend. Amazon executives also spoke at length about how AWS can benefit from a surge in demand for generative AI services.

Investors have also cheered the company’s recent cost-cutting initiatives, which fueled Amazon’s earnings growth in recent quarters. Amazon CEO Andy Jassy has been on a multi-year quest to reign in the company’s spending, including widespread layoffs that have affected more than 27,000 Amazon employees.

It took Amazon more than four years to cross the $2 trillion milestone. Its market cap reached $1 trillion in 2020, the second time in its history after hitting the benchmark for the first time in 2018.