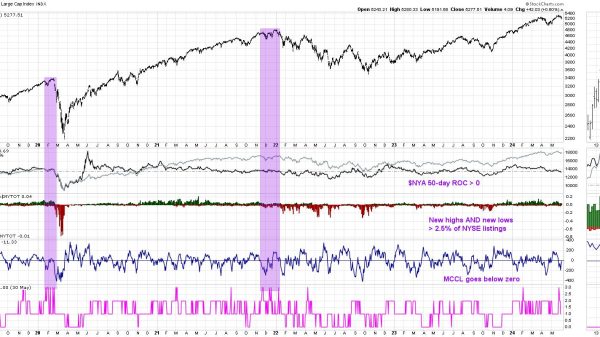

The S&P500 trend conditions have continued this week in “NoGo” conditions despite relief rallies. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds to risk assets. This week we again take a closer look at GoNoGo Trend® conditions across sectors that are trending and outperforming. Notably, consumer staples (XLP) and Utilities (XLU) are in “Go” conditions and outperforming US equities ($SPY) on a relative basis. These are characteristically “defensive” sectors of the market and become attractive to investors during periods of weakness across the broad indices.

Alex and Tyler dig deeper into the industry group level within the utilities sector (XLU) to see electricity providers leading relative outperformance. We pull up NextEra Energy (NEE) and Edison (EIX) to showcase these opportunities within the leading industry group of an outperforming sector.

On an educational note, we show an example of bearish divergence and discuss how to interpret such concepts as a sign of trend weakness or exhaustion, not as a trade signal to exit long positions. Using Boston Scientific (BSX) as an example, we can see that Price is our most important indicator for trade decisions, and while momentum waned, the bearish divergence appeared, and we even saw brief negative momentum, that weakness proceeded a gap higher for price action.